Single homebuyers have a tougher time than most affording a house—and a new report shows single women have it harder than single men.

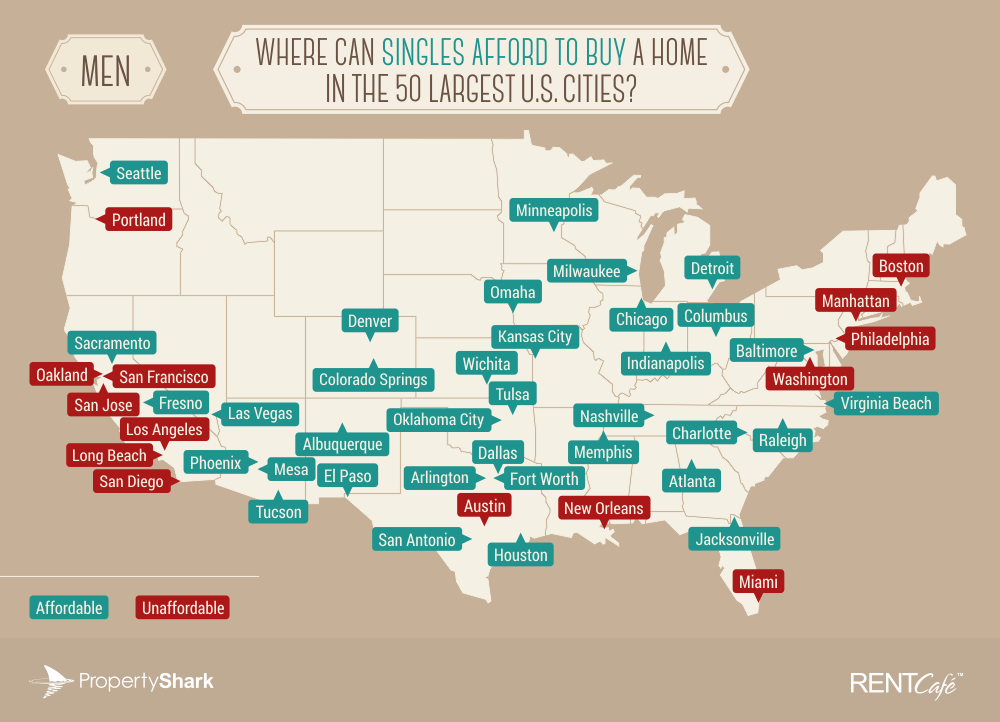

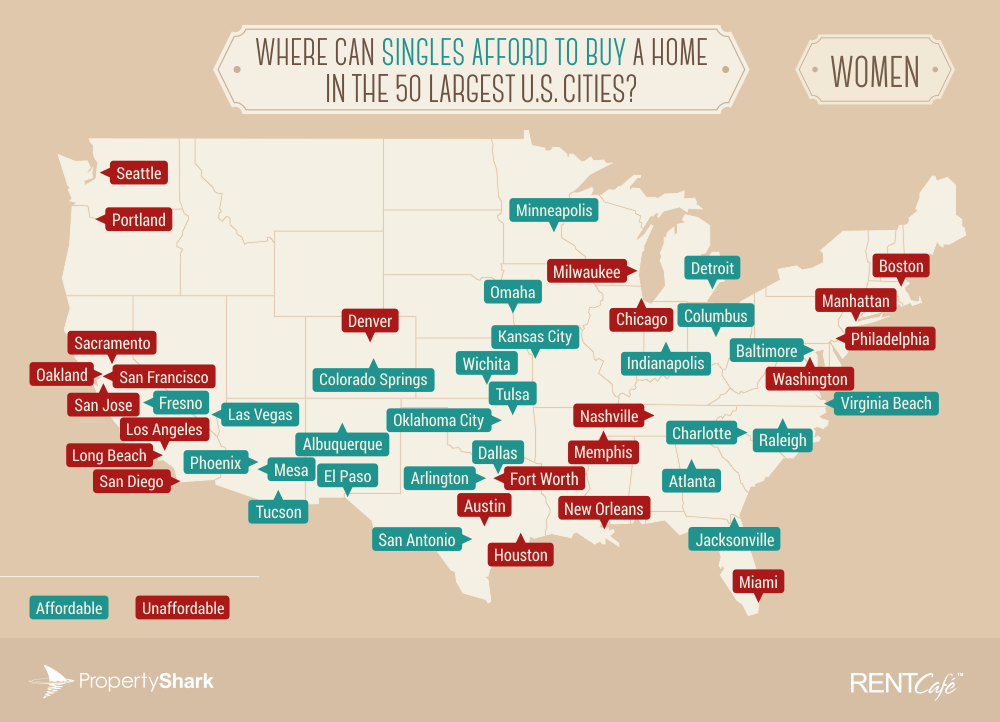

A joint report by PropertyShark and RENTCafé reveals housing in 23 of the nation's top 50 metropolitan areas is out of reach for single women, while housing in 14 areas is out of reach for single men. Austin, Texas; Boston, Mass.; Long Beach, Los Angeles, Oakland, Portland, San Diego, San Francisco, and San Jose, Calif.; Miami, Fla.; New Orleans, La.; New York, N.Y.; Philadelphia, Pa.; and Washington, D.C. are unaffordable to singles regardless of gender—but Chicago, Ill.; Denver, Colo.; Fort Worth and Houston, Texas; Memphis and Nashville, Tenn.; Milwaukee, Wis.; Sacramento, Calif.; and Seattle, Wash. are, in addition, unaffordable to single women. The starkest pay gap of the nine areas unaffordable to single women—but affordable to single men—is in Fort Worth, Houston and Seattle, spanning 70-73 cents on the dollar.

The areas where single women face the lowest housing affordability are New York, Los Angeles, San Francisco, Boston and Miami, according to the report. In New York, monthly housing costs take up 119 percent of the average single woman's income, while in Los Angeles, monthly housing costs take up 104 percent—a full-on shut-out. Monthly housing costs for single men in these areas take up just shy of 100 percent.

There are areas where single women can afford to buy a home: Detroit, Mich.; Wichita, Kan.; Indianapolis, Ind.; and Tulsa and Oklahoma City, Okla., according to the report. The monthly housing cost in Detroit takes up just 4 percent of the average single woman's income, while monthly housing costs in Wichita and Indianapolis take up 10 percent.

View more from the report here.

Please stop this! There are so many factors that go into affordability. Maybe the women are taking care of children and have to take jobs with more predictable hours and less traveling that pay less. Maybe they do have unequal pay. However, when you cite that LA is 104% of women’s pay and just shy of 100% of a man’s pay, neither sex, if single, can afford to purchase real estate in LA. I see many more single women than men buy homes in my area (30 min north of Atlanta) which is affordable for both sexes.

This article is ridiculous. Debt-to-income and credit scores and many other variables come into play.

When I first saw this title, I was not happy. After reading it I remain a bit dismayed as housing is not affordable to a lot of people in very pricey competitive cities. But regardless, credit score, amount saved and career longevity are key factors regardless of sex. I disagree and think this article is a ridiculous angle at an issue that might be in some cities but not in all and again regardless of gender, can you afford a home has everything to do with the above criteria and nothing to do with race. Move to Louisville, KY, I would be happy to help a qualified buyer in whatever price range they can afford. Kelly Hammons, Skelton Co. Realtors, Louisville, KY.

The real estate industry is absolutely insane for anyone in my opinion, I’m lucky my Houston real estate company was happy to keep looking at property after property after property! After 14 months I finally found the perfect home, for the perfect price. Just keep looking and don’t settle!