Tax season is upon us and if you have a pending or recent home sale, you'll surely want to know: what income taxes will you have to pay on the sale?

Tax season is upon us and if you have a pending or recent home sale, you'll surely want to know: what income taxes will you have to pay on the sale?

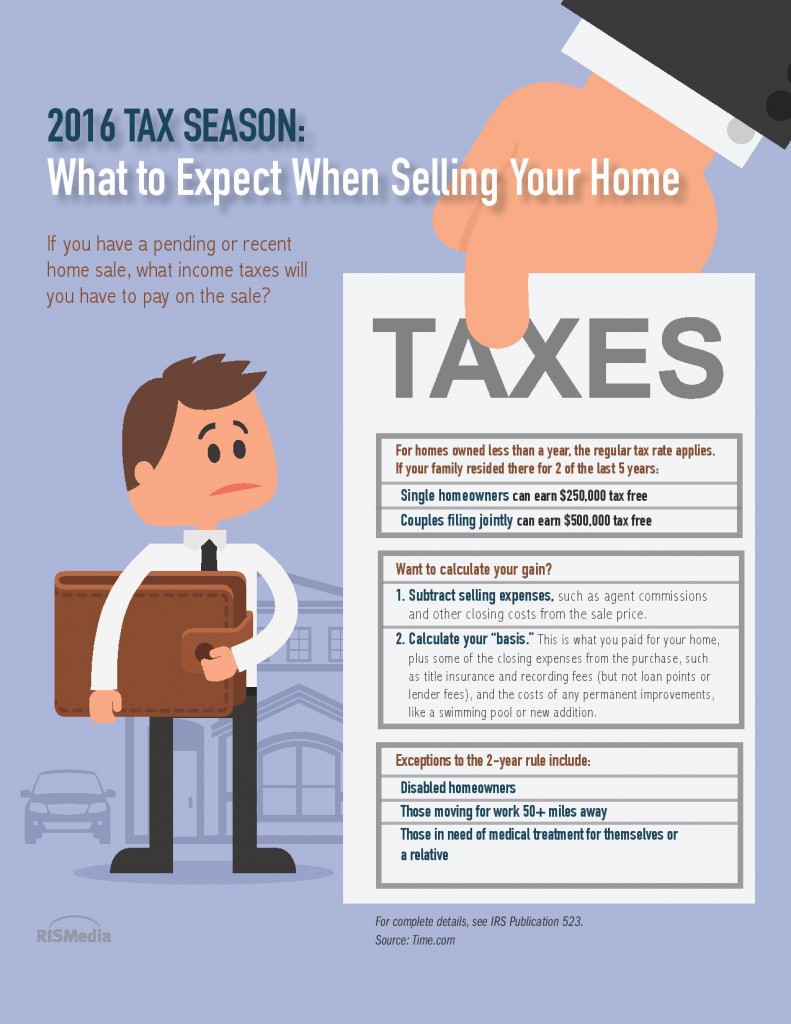

The amount of taxes you'll be responsible for depends on the length of time you've spent in the home. If your family resided in the home for two of the last five years, single homeowners can earn $250,000 tax-free! For couples filing jointly, that number grows to $500,000. If your home sale exceeds your allotment, you'll have to pay capital gains taxes.

For homes owned less than a year, the regular tax rate applies.

Want to calculate your gain? Time suggests the following:

First subtract selling expenses, such as agent commissions and other closing costs, from the sale price. Then you need to calculate your “basis.” This is what you paid for your home, plus some of the closing expenses from the purchase, such as title insurance and recording fees (but not loan points or lender fees), and the costs of any permanent improvements, like a swimming pool or new addition. See IRS Publication 523 for complete details.

Exceptions to the two-year rule do exist, however. For those disabled, relocating for work more than 50 miles away, or for those needing to seek medical treatment for themselves or a relative, taxes on the profit can be pro-rated. It's tricky territory though, so always be sure to consult a tax advisor.

Jut a note, there are a couple o places you could be a bit more clear. For example, “if you’ve lived in the home for at least 2 of the previous 5 years…” and reminding people that the exemption is on profits, not sale price. Just my 2 cents. Thanks!

It is important to add a paragraph explaining the rule regarding the $250k and $500k exemptions in the event of legal separation, divorce or death during the 2-year time period mentioned.

I have heard that there may be a 3.5% tax on the sale effective January 1, 2016 due to Obamacare. Can someone confirm or deny this?

THanks.

Check this article: http://djcoregon.com/news/2012/12/13/the-truth-about-the-real-estate-tax-in-the-affordable-care-act/

Nice article, but would have been nice to mention that there are also other circumstances when depending on that Sellers circumstance, that other taxes may also occur. (ALWAYS check with a CPA, Tax attorney and Estate attorney, preferably BEFORE selling).

i.e.: “FIRPTA Taxes”, for those who are not US citizens/ Greencard holders, and “Out of State Sales Tax” for those Sellers who resided in another state than the state they sold properties they owned. Depending how an estate is set up and How the Seller took ownership, can impact what taxes are paid as well, and often these issues are overlooked.