RISMedia to Release White Paper Investigating Industry ‘Disruptors’

Thousands of real estate professionals have spoken, and the vast majority have concluded that Zillow Instant Offers represents a negative addition to the real estate market for consumers, and another step towards Zillow’s alleged attempt to disintermediate brokers and agents and go directly to homebuyers and sellers.

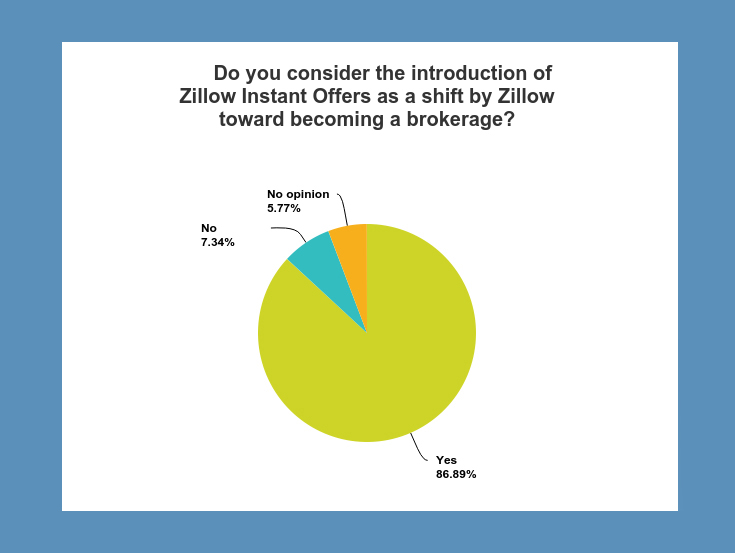

According to an RISMedia Survey launched shortly after Zillow’s introduction of Instant Offers in two test markets—Orlando, Fla., and Las Vegas—nearly 87 percent of respondents consider the introduction of Zillow Instant Offers as a shift towards Zillow to become a real estate brokerage, a strategy that has been anticipated by many since Zillow’s formation in 2006.

Zillow Instant Offers allows home sellers to directly receive all-cash offers from a group of 15 large private investors, who are either licensed as brokers or use a third-party broker license. Offers will be managed by dotloop, which will connect the seller and the investor. While home sellers are encouraged to use a real estate agent to transact the deal, they are not required to do so. Zillow Premier Agents are looped in to prepare the CMAs in their respective markets.

“We have no intention of becoming a brokerage,” says Zillow in a statement to RISMedia. “We have always felt, and will continue to maintain, that agents are a crucial part of the real estate transaction and our goal is to find ways to continue to integrate them in the transaction process, even as the process continues to grow and evolve.”

“Whether it is Zillow’s intent or not, their actions speak louder than words,” counters Candace Adams, president and CEO of Berkshire Hathaway HomeServices New England Properties/New York Properties/Westchester Properties. “Licensing authorities and the courts will make the final judgment as to whether they are operating as a real estate ‘broker.’ What we call ‘traditional brokerage,’ in the sense of agents bringing buyers and sellers together, has already evolved to a professional model. The professional is the most important component of a transaction. Local knowledge and expertise as well as a solid skill set of a professional is critical to the transaction more than ever.”

In its forthcoming White Paper, “The Disruption of the Real Estate Industry: A Survival Guide,” RISMedia will provide the complete results of its Zillow Instant Offers survey, as well as research on the many new business models penetrating the real estate landscape, and strategies for evolving your business to compete. Pre-order your copy at a special discounted rate now.

Offering a counter perspective to the majority, Burke Smith, chief development and learning officer for the Realty ONE Group franchise, does not believe Instant Offers is an attempt by Zillow to become a brokerage.

“This is a gimmick, and if it creates a few extra deals for traditional agents while also shining a needed spotlight on NAR and the state associations to help drive more business to local real estate agents, then I’m all for it. I believe NAR’s new CEO is up for the task. Perhaps this is exactly the wake-up call our industry needs,” he says. “Although I don’t believe Zillow wants to be a brokerage, they may be forced into it in small ways like Instant Offers due to consumer demand, much the same way Netflix did not start out as a production company. Netflix evolved from just streaming other people’s content to producing their own because the consumer needed it, but it is still a small fraction of the production industry. Much the same way Instant Offers will serve a small fraction of the market because there is a market for it, just like there’s a small market for property auctions.”

That said, Smith believes that in many ways Zillow is already a brokerage. “They offer consumers a platform for buying and selling real estate, and they offer agents the prospect of more leads and marketing services than most brokerages do, so all that’s left is letting agents hang their license there and provide them with E&O,” he explains. “Agents should be more concerned about how much money their broker has invested in Zillow, that should have been invested in them.”

In a statement released on nar.realtor after the launch of Instant Offers, the National Association of REALTORS® said, “As a publicly traded company that has yet to show a profit, Zillow will always be experimenting with ways to generate revenue as it must placate its shareholders. The company was not created to protect the interests of real estate professionals. NAR cannot sponsor or encourage a boycott of Zillow. What NAR can do is the same thing we’ve always done in the face of a long line of business models offered to consumers to sell their homes without the use of a REALTOR®: Undertake renewed efforts to remind the public, and to encourage and help members inform their clients and customers, of the value they bring to the real estate marketing and sales transaction, and the problems and risks sellers may encounter in marketing and selling their home without using a REALTOR®.”

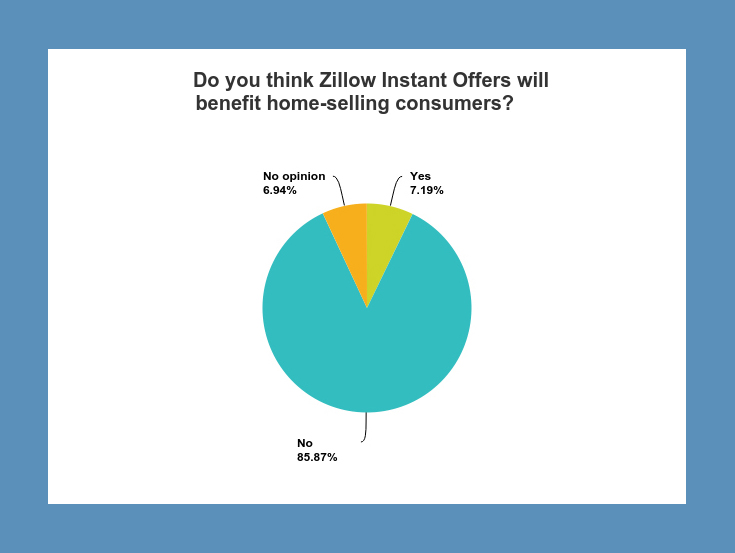

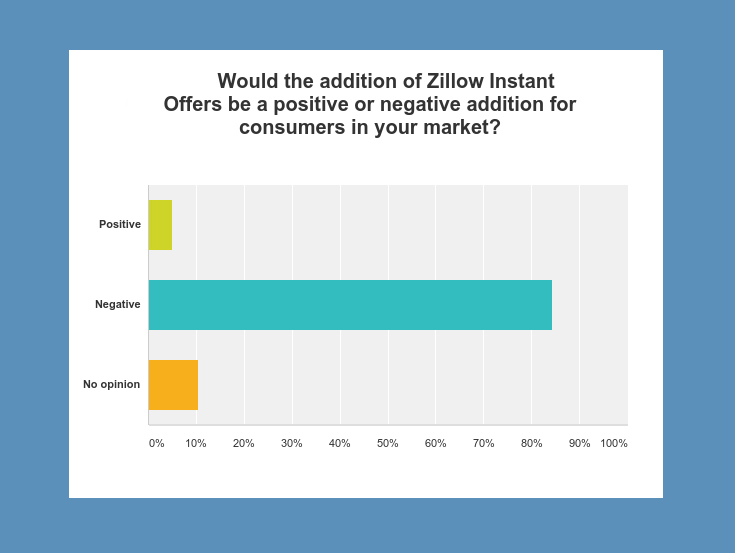

While Zillow claims Instant Offers is not in competition with real estate professionals and is designed to present an alternative to those wishing to sell their home quickly, nearly 86 percent of survey respondents say that Instant Offers will not benefit home-selling consumers. Eighty-four percent of respondents say that Zillow Instant Offers would be a negative for consumers overall in their respective markets.

According to Zillow, “Technology and changing consumer expectations are driving massive shifts in every sector—including the evolution of real estate online. With Instant Offers, our premise is that there are some situations that necessitate a consumer wanting a simpler, more streamlined sale in a shorter period of time—whether it’s negative equity, financial pressures, personal life changes like divorce or a family member passing away whose property is in a different state—and for those situations, we are the only company offering a solution that empowers the consumer to weigh investor offers against an estimate of how much the home would sell for on the open market. For agents, they tell us Instant Offers is a great way to meet sellers. We are the only company that involves agents in this process, and believe it’s the most comprehensive way for a consumer to make a decision.”

“While it’s hard to know what Zillow’s intentions are, the Instant Offers program is clearly a play to generate more revenue from REALTORS® that will pay for these seller leads,” says Matthew O’Connor, COO of New Jersey’s Terrie O’Connor REALTORS®. “Zillow has been very effective at inserting itself between buyers and their agents; they are trying to do the same with sellers.”

Zillow reports that it does not yet have any specific data to share since Instant Offers is still in the test phase; however, they are pleased with the level of engagement thus far. “We’re seeing plenty who really want to sell, and who are contacting the Premier Agent who sent the CMA, or one of the investors. Many of the participating agents are telling us that this has the potential to be a great generator of seller leads, and a number of them have signed listings. One is even close to a closing.”

To hear direct feedback on Instant Offers from one Orlando, Fla., agent, Zillow suggests watching this video.

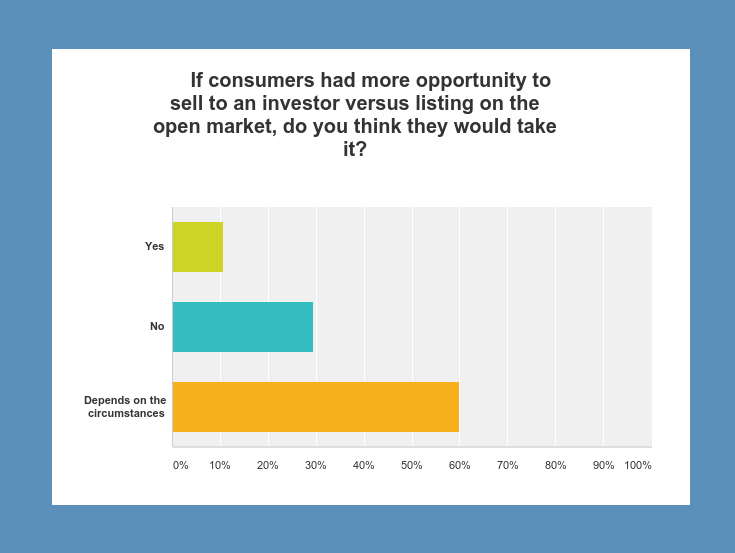

Despite the overwhelmingly negative response to Zillow Instant Offers, some feel it represents just one of many evolutionary models entering the real estate space, and that such shifts are inevitable given the changing demands of increasingly tech-savvy consumers. While nearly 82 percent of respondents believe that homebuyers and sellers are satisfied with the current process of buying and/or selling a home, they were divided in their thoughts on whether consumers would welcome an opportunity to sell to an investor versus on the open market; the majority of respondents (nearly 60 percent) reported that it would “depend on the circumstances.”

“The largest disruptions come from things that people don’t or didn’t know they wanted—think about the iPod and iPhone,” says O’Connor. “The fact that 82 percent of our clients are happy with the current process, I believe, speaks to the value of REALTORS® and the quality work we do trying to help our clients. New business models and technologies have been coming fast and furious for years now; every broker that is still in business has had to adapt—some a little and some radically. We truly live in interesting times.”

Paradoxically, nearly 76 percent of respondents currently syndicate their listings to Zillow, despite very vocally admonishing the company’s attempts to court consumers directly. However, nearly 72 percent say they will not continue to syndicate listings to Zillow if Instant Offers becomes available in their market.

Burke advises agents to keep a big-picture perspective. “Most new business models are not new at all—they are just a twist on something that is already going on in the industry or was tried before,” he explains. “Agents need to understand that the consumer dictates who gets to put the sign in their yard, and if that means they have to adjust their commission or advertise on Zillow, then that is what they need to do. Otherwise, the listing is definitely going to go to a less qualified agent, or consumers will test the waters with companies like OpenDoor. The brokerage of the future will be the one that is willing to evaluate all new technology offerings and provide the best for their agents giving their local real estate professionals the best opportunity for success. Agents need to focus on helping people buy and sell the American dream while their broker focuses on providing them with the best possibilities in technological support both from a marketing and business operations standpoint.”

Adams agrees that the focus needs to stay squarely on the consumer—but that doesn’t diminish the role of the real estate professional; it only strengthens it.

“It is imperative that, as an industry, we understand how buyers and sellers want to communicate and transact,” says Adams. “That does not shift the industry away from anything ‘traditional.’ I define traditional as providing a level of service to our clients that includes professionalism, honesty, dedication and consistency while delivering it on a platform using technology to effectively communicate in a way that appeals to the individual consumer and provides the utmost consumer engagement. I don’t see traditional ever going away—just evolving.”

For a complete analysis and infographic of RISMedia’s Zillow Instant Offers Survey, in-depth insights from respondents and industry leaders, and a “Who’s Who” guide to the new business models disrupting the real estate landscape, pre-order your copy of the RISMedia White Paper “The Disruption of the Real Estate Industry: A Survival Guide” and receive a special early-bird discount.

Maria Patterson is RISMedia’s executive editor. Email her your real estate news ideas at maria@rismedia.com.

For the latest real estate news and trends, bookmark RISMedia.com.