VA loans are having a record 2020. Although the process of obtaining one has slowed in some areas of the country, demand has never been higher. According to mortgage lender Veterans United Home Loans, the VA loan program backed more than 865,000 loans so far this year.

The previous record was set in 2017, when the VA loan program backed some 740,386 loans. This year, that number has been surpassed dramatically, as we're not even through Q3.

"Veterans and military members across the country are capitalizing on historically low interest rates and turning to their home loan benefit in record numbers," Chris Birk, director of education at Veterans United Home Loans, tells Housecall. "This is already the biggest year in the loan program's history."

For veterans with stable income and employment, this has been a remarkable window to buy, to tap into equity or to lock down lower housing costs, according to Birk.

Although the pandemic has impacted the VA loan process in many markets, VA loans on average are moving just as fast or even faster than they did before the coronavirus.

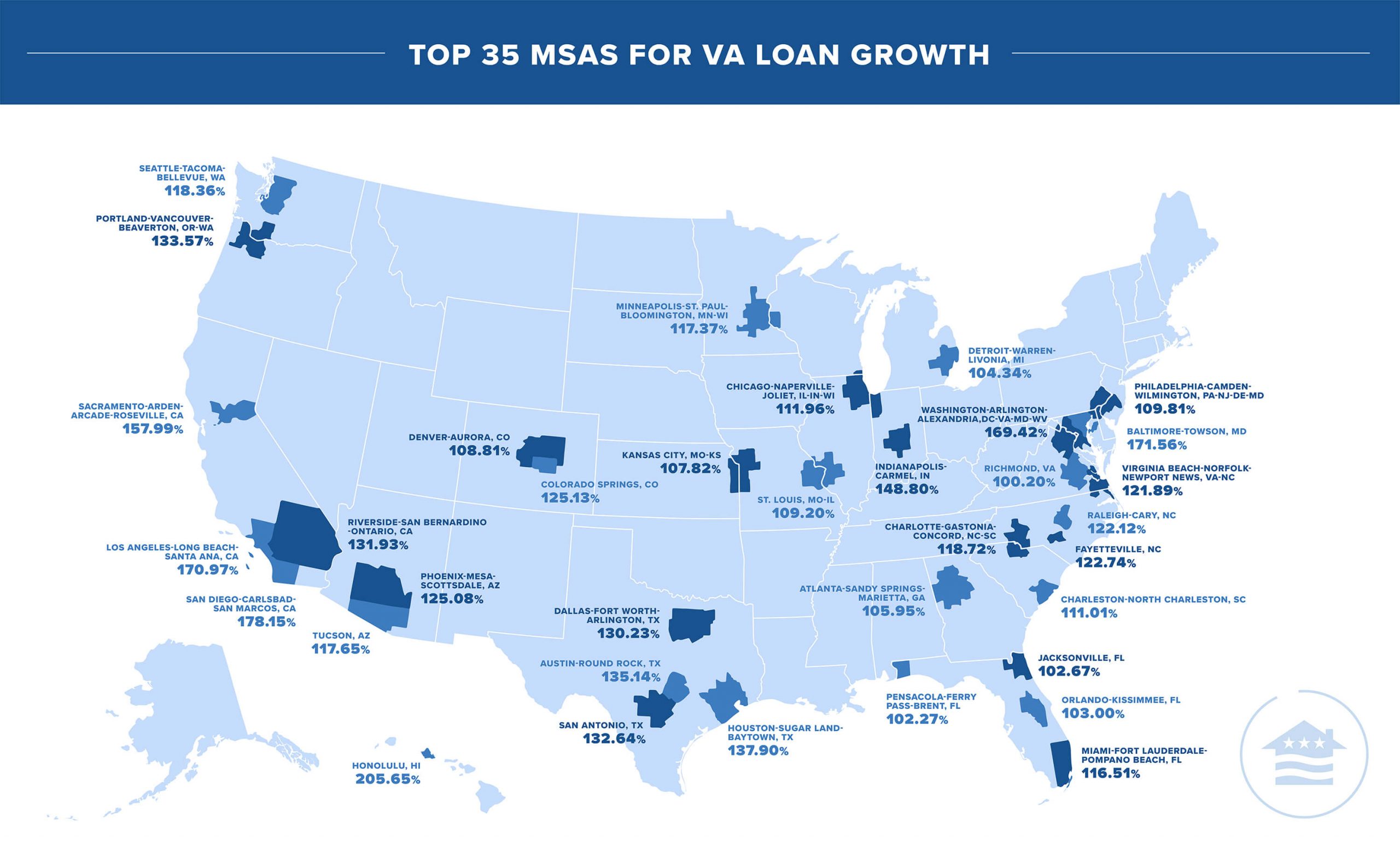

Below is a map produced by Veterans United Home Loans that shows the top 35 metropolitan statistical areas for VA loan growth this year (click to expand).

Credit: Veterans United Home Loans

To view the report and for a full breakdown of Veterans United Home Loans' methodology, click here.