There are over 624,000 veterans and servicemembers in the U.S. who have taken advantage of Veterans Affairs (VA) home loan benefits during 2019, according to a new Veterans United Home Loans report. This is a 43 percent increase compared to just five years ago. And the growth has been consistent, with the number of VA home loans increasing for eight consecutive years.

What's the usage breakdown? According to the report, younger buyers, members of Generation Z and the millennial generations—the only two to see year-over-year growth in purchase loans—accounted for almost half (45 percent) of these purchases in 2019.

Where are these borrowers located? Three states had the highest number of cities (four) ranked in the top 30 list: California, Florida and Texas—Washington, D.C., however, ranked at No. 1.

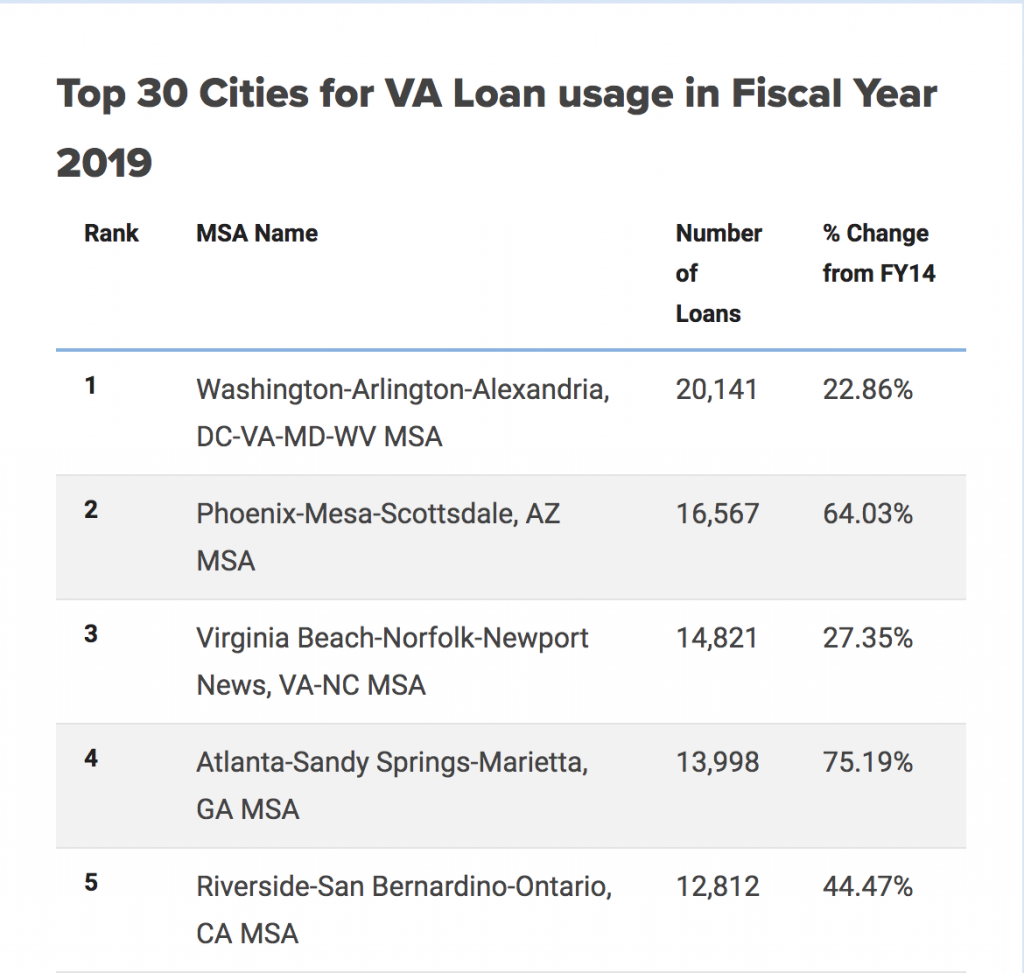

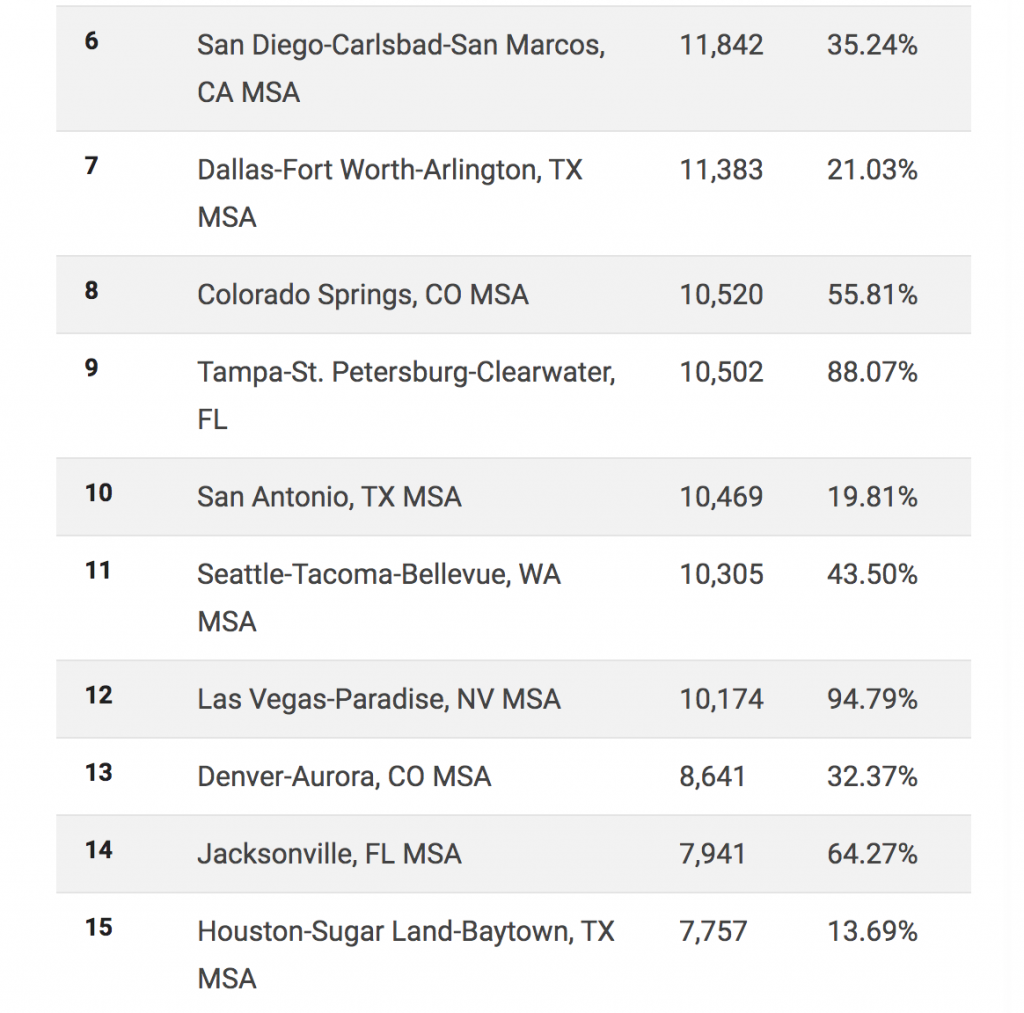

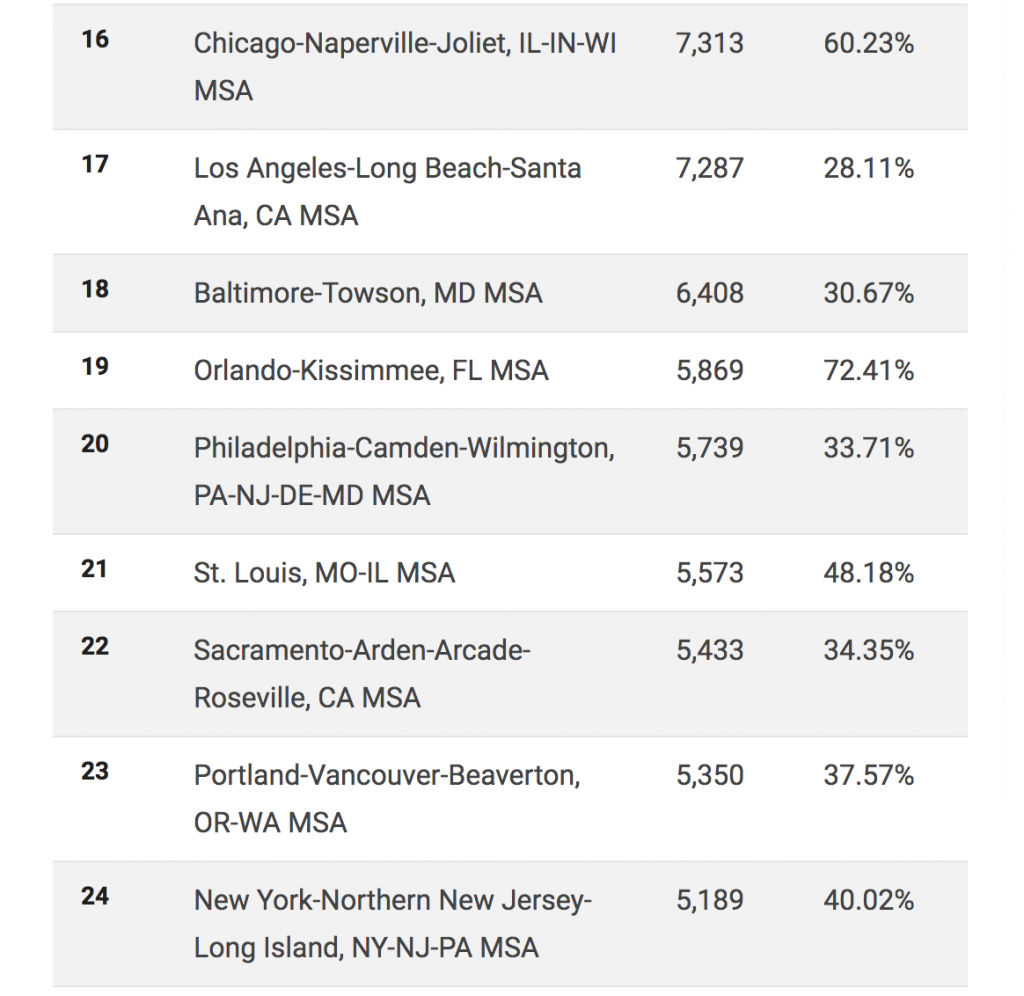

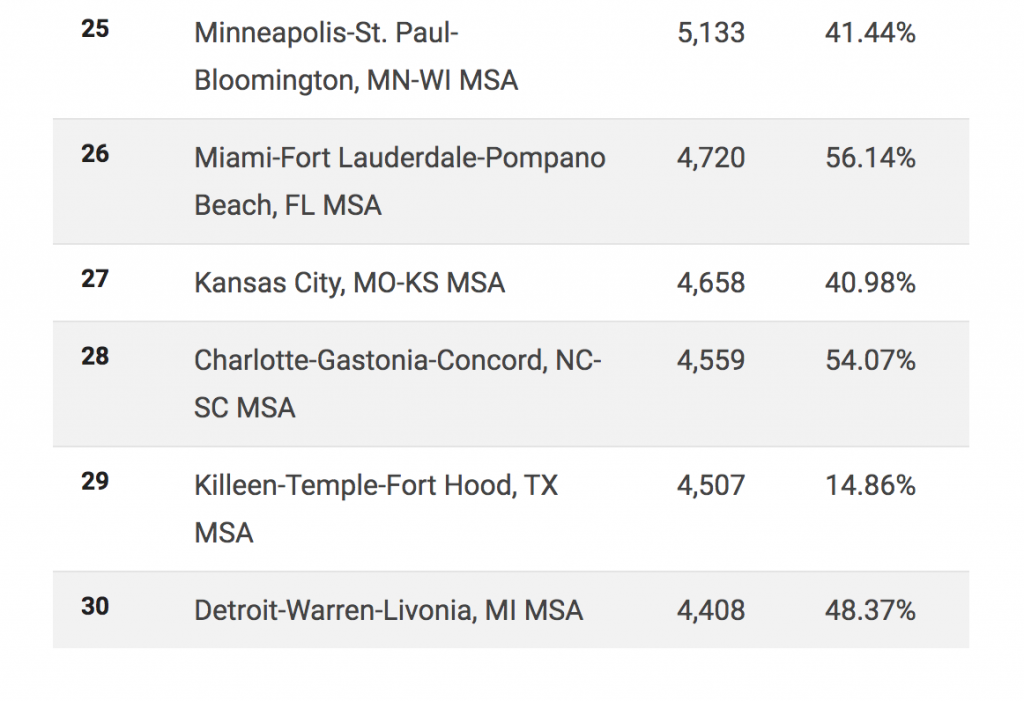

Here are the top 30 cities for VA loan usage for 2019:

Source: Veterans United Home Loans

Over the last 20 years, the VA has backed over 8 million loans. Seventy percent of those were provided in the last decade. And, according to the report, the coming years could see even more of an uptick as changes to VA loan limits take effect on Jan. 1, 2020—especially because VA loans currently have the lowest average interest rate on the market, reports Ellie Mae.

"After 75 years, VA loans are more important than ever. Millennial and Generation Z veterans and servicemembers are driving the growth of this historic benefit program while so many younger civilians are struggling to make homeownership a reality," says Chris Birk, director of Education at Veterans United Home Loans. "With benefits like $0 down payment, flexible credit guidelines and no mortgage insurance, VA loans continue to fulfill their mission to open the doors of homeownership for those who've given so much."

To read the entire report, visit www.veteransunited.com.